Exploring Equifax and Their Practices in Data Brokerage

페이지 정보

본문

In the modern world, the exchange of personal information has become a norm. Companies thrive on understanding consumer behaviors and preferences. Every click, every purchase, and every search contributes to a vast web of knowledge. While this may seem beneficial, it unveils a complex landscape of interactions behind the scenes. The forces at play are not straightforward, and the nuances deserve attention.

On one hand, there are numerous entities eager to collect and analyze user insights. On the other, individuals often remain unaware of how their information is utilized. The relationship between consumers and these organizations is intricate and often opaque. As a result, one can encounter an ecosystem filled with both opportunities and ethical dilemmas. Consumer trust hangs in the balance.

For many, the implications of this exchange are unclear, but the ramifications can be significant. With every piece of personal data shared, a trail of information is created, leading to tailored advertisements, personalized services, and potentially unexpected consequences. The fine line between beneficial collaboration and invasive surveillance is often blurred, raising questions about privacy and autonomy.

The mechanics behind this phenomenon are rarely discussed in depth. It is crucial to explore how various entities navigate this intricate web. By shedding light on these operational dynamics, individuals can better understand the systems that underlie their digital experiences. Knowledge is power, especially when it comes to safeguarding one's own information.

Overview of Equifax's Role in Data Brokering

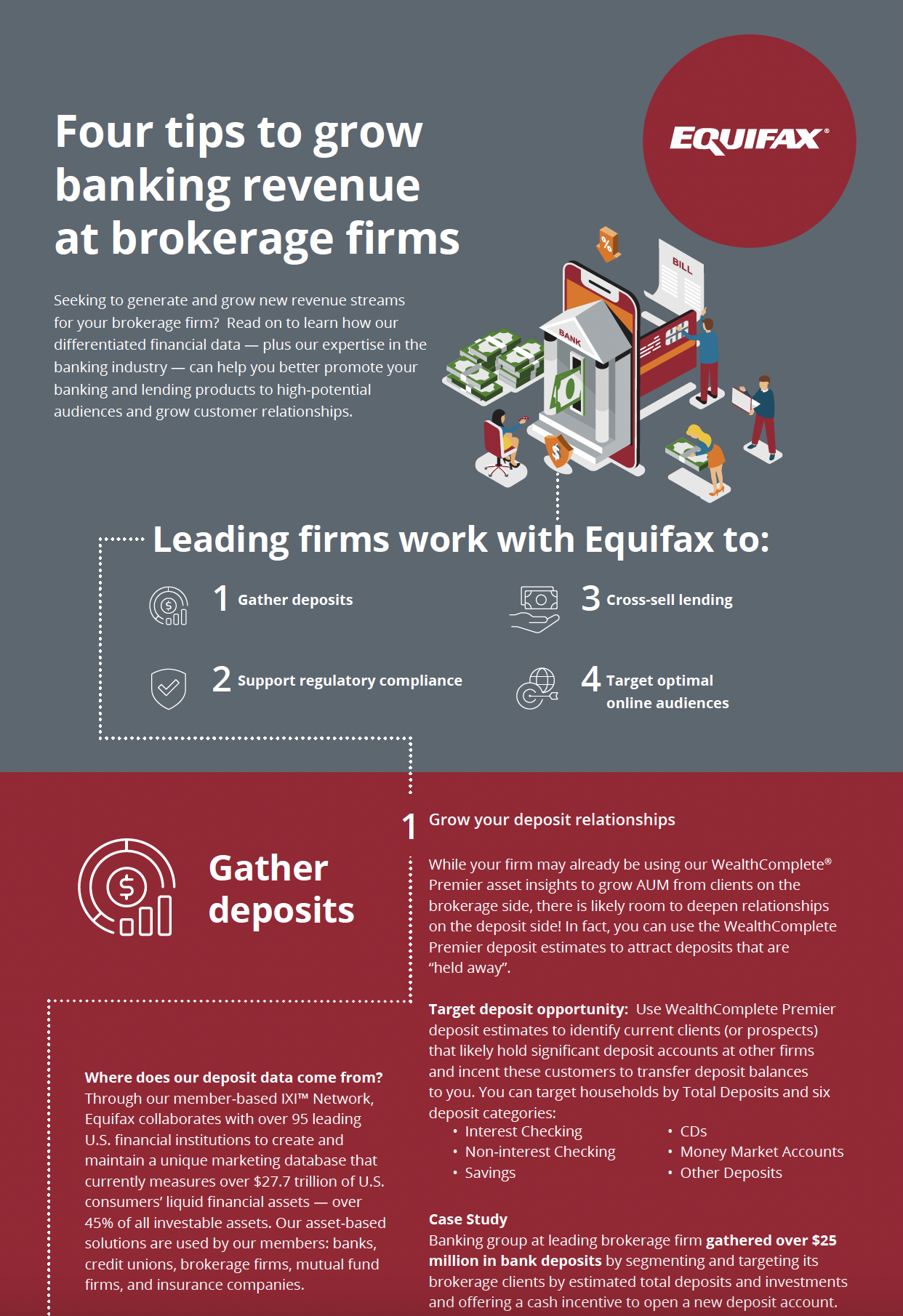

At the core of its operations, this company engages in the collection and distribution of extensive consumer information. The methods it employs to gather such insights are multifaceted and often intricate. By integrating various data sources, the firm constructs detailed profiles. These profiles are invaluable to numerous industries, ranging from finance to marketing.

Information is gathered from public records, credit applications, and other transactional activities. Every interaction can yield valuable details that contribute to the overall understanding of consumer behavior. This continuous accumulation allows for the creation of comprehensive datasets. These datasets are then utilized to provide insights tailored to specific business needs.

The firm collects data from various channels, which include online transactions and even offline purchases. Each data point serves as a piece of a larger puzzle, allowing for a clearer picture of consumer habits. For instance, social media activities can provide insights into interests and preferences. This amalgamation of information facilitates targeted marketing efforts for companies.

Moreover, partnerships with other organizations enhance its ability to gather relevant information. Strategic collaborations with credit unions, banks, and retail chains allow access to a wealth of consumer insights. These connections not only enrich the data pool but also streamline the collection process. By using sophisticated algorithms and analytics, the firm can transform raw data into actionable insights.

As a result, businesses can make informed decisions based on accurate assessments of consumer risk and potential profitability. The firm plays a pivotal role in shaping how companies interact with their customers. It acts as a bridge between consumers and businesses, facilitating transactions while ensuring that stakeholders have the information they need to succeed. This comprehensive approach not only benefits businesses but also highlights the importance of responsible data usage.

In essence, the collection methodology employed by the company is both expansive and precise. It is a continuous cycle of gathering, analyzing, and sharing information that has significant implications for various sectors. Understanding these processes requires an appreciation for the complexities involved in consumer insights and their applications across different industries.

How Equifax Collects Consumer Information

In an era where personal details are currency, the methods of gathering such information are varied and complex. Organizations engage in a multitude of techniques to compile comprehensive profiles of individuals. From online behavior to financial records, the sources are diverse. This ongoing collection process raises important questions about privacy and security. Every interaction we have online leaves a digital footprint, often unbeknownst to us.

One significant means of information acquisition revolves around public records. These can include legal filings, property records, and court documents. By tapping into these resources, firms can obtain insights into an individual’s history and affiliations. Additionally, credit transactions reveal much about spending habits and financial stability.

Another approach involves the collection of information from third-party entities. Various companies compile data and sell it as part of their business strategy. This creates an intricate web of interconnected data sources. Furthermore, social media platforms stand out as rich domains for information gathering. The details shared by users on these networks can be harvested to enhance demographic profiles.

The advent of technology has revolutionized the methodologies employed in consumer information collection. With the rise of sophisticated algorithms, organizations can analyze vast amounts of data in real-time, uncovering trends and behaviors that were previously unnoticeable. This ability allows them to create accurate assessments of consumer preferences, habits, and potential needs, ultimately influencing marketing strategies and service offerings.

Moreover, direct interactions with consumers provide a wealth of information. Through surveys, registrations, and applications, organizations can gather vital insights. Individuals often volunteer significant details about themselves in exchange for benefits such as discounts or services. This voluntary sharing can lead to comprehensive datasets that shape future engagements.

In summary, the collection of personal information is multifaceted, involving both passive and active methods. While it allows for tailored experiences and improved services, it simultaneously raises crucial considerations regarding ethical implications and consumer rights. As individuals, being aware of these practices can empower us to make informed choices about our digital presence.

Impact of Data Breaches on Consumers

When sensitive information is compromised, it can lead to serious consequences for individuals. The ramifications of such incidents stretch far beyond initial shock, affecting lives on multiple levels. Victims may face identity theft, financial loss, and emotional distress. Rebuilding trust, both in institutions and in personal security, becomes a long and arduous journey.

Identity theft is one of the most alarming outcomes following a security breach. Thieves can use stolen personal details to open new accounts, make unauthorized purchases, or even commit fraud in the victim's name. The process of resolving these issues can take months or even years, leaving individuals in a state of uncertainty.

Additionally, financial repercussions can be devastating. Consumers may find themselves incurring unexpected expenses due to fraudulent activities or the need for credit monitoring services. Some might even suffer long-term credit score damage, complicating everything from loans to employment opportunities.

Moreover, the emotional toll cannot be overlooked. Victims often report feelings of anxiety, vulnerability, and violation. These emotions can affect daily life, leading to stress-related health issues. Some even experience long-lasting psychological effects that can alter their relationship with technology and trust in institutions.

Beyond immediate effects, there are larger implications for society. Each breach raises awareness about the need for robust cybersecurity measures. It prompts individuals to reconsider how they share personal information. Many begin to demand greater transparency from corporations regarding their security practices.

In conclusion, the fallout from compromised information extends to individual lives and, more broadly, societal trust. Understanding these impacts underscores the importance of vigilance and proactive measures in protecting personal information. As technology continues to evolve, so too must the strategies to safeguard sensitive data, ensuring that consumers can engage confidently in an increasingly digital world.

The Impact of Data Breaches on Consumers

Data breaches have become a prevalent threat in today's interconnected world. They can affect anyone, from individuals to large organizations. When sensitive information is compromised, the consequences can be severe. Many consumers find themselves at risk of identity theft and financial loss. The anxiety that stems from knowing one’s personal information is exposed is palpable.

Recently, the number of security incidents has surged, making the protection of private information more critical than ever before. Individuals often experience a loss of trust towards institutions that fail to safeguard their details. This erosion of confidence can lead to significant emotional stress. Moreover, the aftermath of such breaches can have lasting effects on a person’s credit score and financial stability, instilling a sense of vulnerability. The implications extend beyond immediate financial concerns, as they can also derail future opportunities.

Additionally, affected consumers may face ongoing struggles to monitor their financial health. The repercussions can be far-reaching, often requiring extensive recovery efforts that consume time and resources. Victims frequently spend countless hours disputing erroneous charges or fraudulent accounts. While organizations may offer solutions, such as identity theft protection services, the effectiveness of these programs varies significantly. Sadly, many individuals do not realize the full extent of the damage until it is too late.

Furthermore, the regulatory environment is evolving to address these challenges, but gaps still remain. New laws aim to provide greater protections, yet enforcement can be inconsistent. Many consumers remain unaware of their rights regarding breaches and the recourse available to them. Increased transparency in how companies handle sensitive data is essential. Raising awareness about personal data rights can empower individuals to take control of their information.

As technology continues to advance, so do the methods employed by cybercriminals. Consequently, it is imperative that consumers remain vigilant and proactive in defending against potential threats. Understanding the nature of these breaches and the rights one possesses is crucial. The more informed individuals are, the better equipped they will be to protect themselves and recover from any unfortunate incidents.

Ultimately, the consequences of data exposure are profound and wide-ranging. They reach far beyond financial damages, affecting mental well-being and trust in the systems that govern our daily lives. As a society, we must work to cultivate a culture of security and accountability, ensuring that our personal information is treated with the utmost care.

Legal Regulations Affecting Data Brokers

The landscape of privacy and consumer rights is complex and ever-evolving. Numerous laws govern how personal information is collected, shared, and utilized. These regulations are essential for protecting individuals from potential misuse. They serve to ensure that companies are held accountable in the handling of sensitive data. In recent years, the scrutiny over the actions of various entities has intensified significantly.

Governments and regulatory bodies have recognized the urgent need for comprehensive policies. As a result, various jurisdictions have implemented specific rules that dictate how information can be processed. For instance, laws like the General Data Protection Regulation (GDPR) in Europe impose strict guidelines on consent and data usage. Similar approaches are being adopted in various states across the United States, emphasizing transparency and consumer rights.

Moreover, legislation is often developed in response to high-profile data breaches and privacy scandals. These incidents have raised public awareness and shaped discourse around personal privacy. Consequently, lawmakers are pushed to act, creating frameworks that promote ethical handling of information. Such laws require companies to disclose their practices clearly to consumers.

The Fair Credit Reporting Act (FCRA) is another significant piece of legislation that impacts how personal information is managed. It establishes guidelines for consumer reporting agencies, ensuring individuals have rights to access and dispute information about themselves. In addition, states such as California have enacted the California Consumer Privacy Act (CCPA), which grants citizens more control over their data. These measures reflect a growing recognition of individual rights in an increasingly digital world.

As technology advances, challenges arise in enforcing these regulations consistently. The rapid evolution of the internet and digital services complicates compliance. Furthermore, not all jurisdictions approach the protection of personal information in the same manner. Therefore, businesses involved in information collection must stay vigilant and informed about local laws and regulations. Misunderstanding or disregarding these rules can lead to severe repercussions.

In essence, the legal framework surrounding the management of personal information is crucial for safeguarding consumer interests. Continuous dialogue among lawmakers, businesses, and the public is necessary to adapt these regulations to new technologies. As society becomes more intertwined with digital platforms, understanding the implications of these laws is paramount for everyone involved.

Recent Trends in Data Monetization

In today's digital landscape, the commercialization of personal information has become increasingly prevalent. Businesses are constantly seeking new ways to leverage consumer data for profit. This includes everything from targeted advertising to predictive analytics. As technology evolves, so does the marketplace for information. Understanding these shifts is crucial for both consumers and companies.

One emerging trend is the rise of subscription-based models for accessing consumer insights. Companies are now offering analytics services that allow clients to gather detailed profiles on potential customers. This approach contrasts with older, one-time purchase models. It reflects a deeper integration of data into business strategies.

- Increased focus on privacy and consent.

- Growth of artificial intelligence in data analysis.

- Expansion of data-sharing partnerships between firms.

- Rising demand for real-time analytics.

Moreover, the implementation of stricter privacy regulations has prompted organizations to reevaluate their strategies. These legal frameworks are designed to protect consumer rights. Companies must now be more transparent about their practices. This shift impacts how information is collected, stored, and sold.

Another notable trend is the emergence of decentralized data-sharing platforms. These platforms empower individuals to control their information while providing businesses with aggregate insights. Consequently, more consumers are becoming aware of their ability to monetize personal data, leading to a growing market for peer-to-peer data exchanges.

Overall, the trends in information commercialization indicate a transformative shift in how businesses interact with consumer data. The landscape is rapidly changing, and both consumers and companies must adapt to these new realities. With the rise of technology and regulatory changes, the future landscape presents both challenges and opportunities for stakeholders.

Recent Trends in Data Monetization

The evolving landscape of consumer information has sparked fascinating trends in profit generation. Organizations are increasingly recognizing the value of collecting and sharing information. With the rapid growth of technology, new avenues for revenue generation have emerged. This shift has transformed how entities view personal details. It’s no longer just about retention; it’s about capitalizing on the wealth of insights available.

Recent developments demonstrate a noticeable shift towards personalized offerings. Businesses are leveraging consumer insights to tailor products and services more effectively. As a result, the marketplace is witnessing heightened competition, with companies striving to stand out. This approach often involves sophisticated algorithms and machine learning techniques to interpret vast amounts of information.

Moreover, the rise of social media has played a pivotal role in this trend. Platforms gather extensive user insights, which are then monetized. Advertisers are now able to reach specific demographics with pinpoint accuracy. The influence of digital footprints cannot be overstated; they guide strategies and fuel growth in unprecedented ways.

However, the ethical implications surrounding these practices are coming under scrutiny. Consumers are increasingly aware of how their information is utilized. This awareness has led to calls for greater transparency and stricter regulations. Organizations must navigate a fine line between innovation and respecting privacy rights.

In this dynamic environment, partnerships are becoming a common strategy for maximizing potential. Companies collaborate to share resources and insights, enhancing their reach and effectiveness. These alliances often lead to the creation of comprehensive profiles, combining multiple sources of information for improved targeting.

As we look ahead, the future of profit generation from consumer insights will likely evolve further. New technologies, such as artificial intelligence, will undoubtedly transform how organizations operate. This relentless pursuit of information will continue to redefine market strategies. Understanding consumer behavior will remain at the forefront, but organizations must tread carefully to maintain trust.

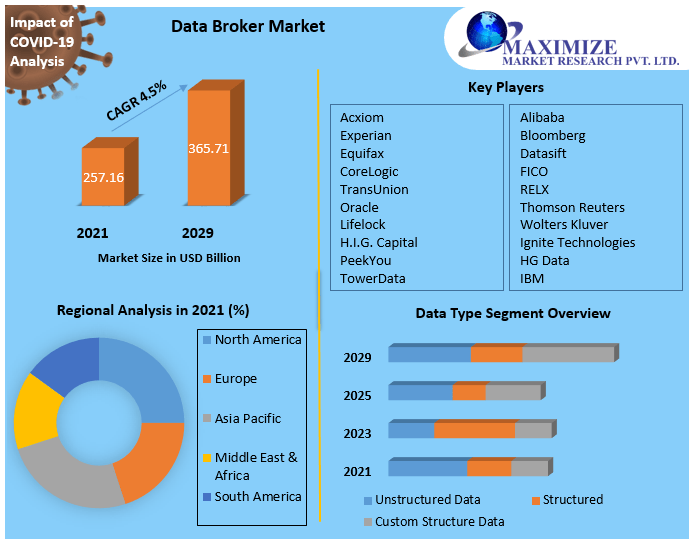

Equifax’s Competitive Landscape in Brokering

The realm of information exchange is multifaceted and dynamic. It involves various players who engage in sourcing, analyzing, and selling consumer data. This ecosystem is shaped by competition, innovation, and the regulatory environment. Consequently, organizations must navigate these complexities to maintain their market position.

Several major entities operate alongside Equifax, each vying for market share and consumer trust. These companies utilize advanced technology to collect and analyze vast amounts of personal information. As a result, they can offer specialized services that appeal to businesses and marketers alike. In this ever-evolving landscape, staying ahead of competitors is crucial.

Competition drives improvements. It fosters innovation within the industry, pushing firms to refine their methodologies and expand their service offerings. New players continually emerge, aiming to disrupt the status quo and capture consumer interest. This creates a vibrant market where adaptation is key.

In the following table, we outline some significant competitors in this sector, highlighting their primary focus areas and unique propositions:

| Company Name | Focus Area | Unique Proposition |

|---|---|---|

| Experian | Credit Reporting | Comprehensive credit monitoring and scoring tools |

| TransUnion | Identity Protection | Integrated identity theft protection services |

| Dun & Bradstreet | Business Information | Extensive data on businesses for risk assessment |

| Acxiom | Marketing Solutions | Data-driven marketing strategies to enhance customer engagement |

Furthermore, consumer expectations are evolving rapidly. They demand transparency, security, and ethical handling of their personal information. Companies must, therefore, prioritize these aspects to stay relevant in a crowded marketplace. The consequences of failing to meet these expectations can be dire, including reputational damage and loss of customer loyalty.

In conclusion, the competitive environment is both challenging and invigorating. Organizations must continuously adapt to shifting market dynamics and consumer preferences. The key lies in understanding not just the competition but also the broader trends that influence consumer behavior and regulatory landscapes.

How to Protect Your Personal Data

In our increasingly connected world, safeguarding personal information is more important than ever. The vast amount of data that is collected, stored, and shared can lead to significant risks if not properly managed. Individuals often feel vulnerable, wondering who has access to their information and how it is being utilized. It's essential to take proactive measures to enhance your privacy in various settings.

Here are some strategies to consider:

- Use strong, unique passwords for different accounts.

- Enable two-factor authentication wherever possible.

- Regularly update your software to patch vulnerabilities.

- Be cautious when sharing personal information online.

- Review the privacy settings on social media platforms.

Moreover, understanding the potential consequences of data exposure can motivate individuals to prioritize their security. For example, a single data breach could lead to identity theft or financial fraud. Therefore, taking charge of personal information is vital, especially in environments where it can be easily mishandled. It’s not just about protecting oneself but also about fostering a culture of awareness and caution.

Additionally, consider utilizing privacy-focused tools and services. This can include using a Virtual Private Network (VPN) while browsing or installing ad blockers to limit unwanted tracking. Regularly monitoring your financial statements can help detect any unauthorized transactions early. Customizing your privacy preferences on different platforms will bolster your defenses and help maintain control over your digital footprint.

Moreover, staying informed about emerging technologies and trends can significantly enhance your protective measures. Knowledge is power. Understanding how companies utilize information allows individuals to make more informed choices. Being vigilant in reviewing privacy policies and terms of service can seem tedious, but it's a necessary step toward safeguarding your rights.

Ultimately, protecting oneself in this digital age requires an active approach. Relying solely on organizations to secure your information is not enough. Each individual must take responsibility and cultivate a heightened awareness of their personal security. This proactive stance will help create a more secure environment for everyone.

How to Protect Your Personal Data

In today’s digital age, safeguarding your personal information is crucial. The online world offers many conveniences but also exposes individuals to risks. It's essential to be proactive in protecting your details. Simple steps can make a significant difference. Awareness is your first line of defense.

Consider using strong, unique passwords for each of your accounts. Password managers can help you manage and generate secure passwords effortlessly. Additionally, enable two-factor authentication wherever possible. This extra layer of security adds an essential barrier against unauthorized access. Remember, relying solely on passwords is no longer sufficient.

Regularly monitor your financial statements and online accounts for any suspicious activity. If something seems off, report it immediately. Utilize alerts to stay informed about account changes, purchases, or logins. Primarily, never ignore any signs of potential identity theft. Prompt action can significantly mitigate damage.

Be cautious when sharing personal information online. Always question whether you genuinely need to provide information and who is requesting it. Limit what you share on social media platforms, as this can be a goldmine for identity thieves. Familiarize yourself with privacy settings on every application you use. It’s your right to control your information.

- Use a Virtual Private Network (VPN) for secure browsing.

- Regularly update your software and applications.

- Educate yourself about phishing scams and how to recognize them.

- Shred sensitive documents before disposal.

- opt out radaris-out of information sharing when possible.

Backing up your data is also essential, and using cloud storage might be a great solution. However, choose reputable providers that prioritize security measures. Make sure they encrypt your data and have solid privacy policies. Always read terms and conditions before committing any information.

Lastly, consider reviewing your rights concerning your personal information. Laws and regulations exist to protect consumers. Familiarize yourself with these rights to ensure you are not taken advantage of. Understanding your options empowers you to take action if necessary.

The digital landscape is continually evolving. Therefore, staying informed about the latest security tips and tools is vital. Protecting your information is an ongoing commitment, requiring vigilance and awareness. By adopting these strategies, you can significantly enhance your defenses against potential threats.

Future of Data Brokering Practices

The landscape of personal information sharing and monetization is rapidly evolving. As technology advances, so do the methods of collecting and distributing consumer insights. This shift raises important questions about privacy and control. How will individuals navigate this complex web of information exchange? The answer lies in understanding emerging trends and anticipation of future developments.

One major trend is increasing consumer awareness. More people are recognizing the implications of sharing their personal details. They are becoming cautious about how their information is utilized. This growing consciousness is prompting companies to adopt more transparent practices.

Regulatory changes are also on the horizon. Governments worldwide are examining the adequacy of existing frameworks. In response to rising privacy concerns, stricter regulations are likely to emerge. These changes aim to protect individuals and empower them with greater control over their personal information.

- Emergence of new technologies, like blockchain, enhancing data security.

- Greater emphasis on user consent and informed choices.

- Shift towards ethical data utilization among businesses.

- Development of tools for consumers to manage their data.

Furthermore, the rise of innovative platforms is reshaping how consumers interact with their own data. Such platforms facilitate direct connections between individuals and organizations, allowing for more equitable exchanges. This shift presents a unique opportunity for enhanced transparency and trust in transactions.

As consumer behavior evolves, organizations will need to adapt. They will be compelled to prioritize user privacy and ethical considerations. This could lead to a competitive advantage for those who genuinely invest in fostering respectful relationships with consumers.

- Empowerment through tools that allow for individual data management.

- Increased scrutiny of companies’ data handling practices.

- Collaboration between stakeholders to establish best practices.

The confluence of these factors will undoubtedly shape the future of information dissemination. In this new era, it is essential for both consumers and businesses to engage in open dialogue. Such discussions can lead to a healthier ecosystem, where information is shared responsibly and with mutual benefit.

Ultimately, the journey ahead will be defined by collective actions and evolving norms. Adapting to the future is not just about technological advancements. It’s about fostering a culture of respect and understanding within the marketplace, where personal data is treated as a valuable asset rather than a mere commodity.

- 이전글Is that this رقم نقل عفش Factor Actually That onerous 24.09.25

- 다음글электромагниттер және оларды қолдану 24.09.25

댓글목록

등록된 댓글이 없습니다.